Rebecca Goodman

Rebecca Goodman is actually a freelance journalist who has got invested for the past a decade functioning round the individual finance guides. Regularly writing towards the Protector, Sunlight, New Telegraph, as well as the Independent.

Katrina Haggarty

Katrina possess 12 years’ value of expertise in article marketing, purchases, and you will modifying, along side monetary features and you will musical-artwork groups. She started their own field within a global AV seller prior to to get a paign Director for Virgin Currency, in which she invested 5 years emphasizing operating its Investment and you will Retirement benefits channels. She went on to join Learn Your money, which NerdWallet acquired in 2020. Once giving support to the content team’s development, she try marketed so you can Publisher when you look at the 2021.

Jump so you can

- What exactly is a standard on a home loan?

- How come a standard connect with their mortgage?

- The way to get a mortgage just after a standard

- Might you get a mortgage which have a standard?

- How can i get a standard taken off my credit file?

Missing home loan repayments and obtaining demanding characters from your own bank normally be scary, specifically if you features household members that you’re accountable for as well.

not, because worrying as a home loan default might be, you can be confident you to definitely the manner in which you address the trouble tend to determine the end result of a standard. The sooner you can type some thing away, the lower the possibilities of it causing you long-identity difficulties.

Here we glance at all you have to realize about mortgage non-payments and actions you can take to win back command over your situation and keep your residence secure.

What’s a default into a home loan?

As soon as you miss otherwise make a lower percentage for the your own mortgage, you risk causing harm to your own borrowing from the bank reputation. Once this happens, the options start to become more tough. If you feel you will not have the ability to build good homeloan payment, your very best step is to contact your financial seller ahead of time.

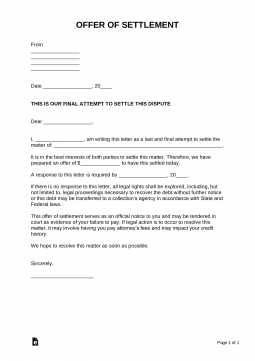

Ahead of your own financial goes in default, you’ll very first become sent a default find by the bank. So it constantly happens for those who have overlooked or made less money to own a time period of 3 to 6 days.

You could think about a standard find just like the an alarm bell otherwise red-flag. You should currently end up being speaking with their bank at this stage but if you haven’t, this is the time while making you to name.

The fresh new see offers two weeks to catch up with your payments. For many who have the ability to do this everything productivity to normal, however your credit character will show late or overlooked mortgage payments. Although not, if you can’t, your account will commercially enter default.

Yet your bank may take action to locate the money www.paydayloanalabama.com/ridgeville back. This includes their lender providing one courtroom and may even lead to it repossessing your house.

How does a default connect with their home loan?

For those who have a mortgage and also you believe you’ll or you’ve got currently defaulted towards a payment, you will need to try to be in the near future as you’re able to, to help you rectify the difficulty.

It means getting in touch with your own mortgage lender quickly and being open and you can honest on the the reason you are having difficulties. After they has a far greater knowledge of your position and certainly will see that you are working to handle the trouble, they are expected to feel flexible.

Oftentimes, you happen to be in a position to built an option contract with your financial. This could is mortgage repayment getaways otherwise reducing your money so you’re able to an even more under control number to have a finite big date. You might be capable stretch the definition of of mortgage to attenuate the month-to-month costs otherwise briefly switch to interest-simply. It’s also possible to have the ability to remortgage to a different contract.